Summary

- This is the first quantitative assessment of skills demand in the UK space sector.

- We analysed 812 early career UK space sector job adverts using our previously developed competencies taxonomy to identify competencies in highest demand within the UK space sector.

- The most sought after technical skill is software development (required by 49% of all jobs), particularly in C/C++ (22%) and Python (20%).

- This suggests the space skills shortage is largely a tech skills shortage, and shows that programming skills must be a strategic priority for the sector’s skills strategy.

- There is also a high demand for transferable skills including interpersonal (84%) and communication (76%) skills.

- This further demonstrates the importance of these skills, and that the sector must ensure that they are taught and developed alongside technical ones.

Introduction

The UK’s space sector is growing at a rate of more than 3% per annum, creating hundreds of new jobs each year 1a, and has set the goal that it should have a global market share of 10% by 2030 2.

However, UK space companies are facing a skills shortage. 68% predict that they will be hiring over the next 3 years, but already more than half of large organisations report being worried about having access to skilled workers, and nearly 40% of all organisations say staff recruitment is a major barrier to their growth 1c.

Though there is a lot of anecdotal evidence of skills shortages in particular areas 3, there is very little detailed data available for the sector on the relative demand for different skills. Understanding exactly which competencies the sector is lacking is vital in informing provision of training and approaches to recruitment.

To address this, we have developed a taxonomy of space sector skills 4 and used this to give the first quantitative assessment of skills demand in the sector.

Though the sector normally talks about ‘skills’ shortages, in the rest of this document we use the word ‘competencies’ instead so that we can talk about traits, knowledge, skills, and qualifications separately.

Methodology

Dataset

SpaceCareers.uk is a British space jobs board operated by UKSEDS, the UK’s national student space society, which focuses on apprenticeships, internships, graduate schemes, PhDs, postdoctoral fellowships, and other early careers opportunities. The cutoff criterion is that positions require no more than three years of experience. We analysed job adverts posted on SpaceCareers.uk between December 2015 and December 2019.

The initial dataset contained just under 1300 adverts. We cleaned this dataset by removing duplicate adverts, and excluding all adverts which were not for internships, graduate positions, or direct entry jobs. This left us with 812 adverts (referred to as the SCUK dataset). The characteristics of the datasets are given in the Appendix, and its limitations are discussed in the Limitations section.

Competencies taxonomy

We analysed the dataset using our previously developed competencies taxonomy and library of natural language examples of competency descriptions. An overview of the taxonomy is provided here for context. The full taxonomy and a more detailed explanation of its structure can be found on a separate page.

The taxonomy has a hierarchical structure with up to five levels:

- Competency type (trait, knowledge, technical skill, transferable skill, or qualification)

- Trait – features of a person’s character or personality, embodied by certain behaviours

- Knowledge – facts or information about a given topic

- Technical skill – a skill which is specific to a sector or job

- Transferable skill – a skill which can be applied in a similar way to most jobs

- Qualification – a formal recognition of certain knowledge or skills following an assessment process by a relevant body

- Thematic area (science & engineering, programming & computer science etc.)

- Competency

- Subcompetency (if necessary)

- Subcompetency (if necessary)

Qualifications were not included in this analysis, but will be a topic of future work.

Each item in the taxonomy has a specific code representing the hierarchical levels. For example, the code ‘3.2.1.1.1’ represents the following:

3.2.1.1.1

3 - Technical skills

2 - Programming & Computer Science

1 - Process and analyse data

1 - Geospatial data

1 - GNSS data

Analysis

A competency can be described in a job advert in a number of different ways. For example, the taxonomic entry of ‘communication skills’ might be described as ‘communication and presentation skills’ or ‘written and verbal communication’.

We measured how often each specific competency was mentioned across the whole dataset, and additionally how many job adverts mentioned at least one competency in each category. In this way, we obtained a measure of the frequency with which particular competencies were mentioned.

Subcompetencies were grouped with their parent competency, so mentions of ‘Matlab’ (3.2.3.11) and ‘Python’ (3.2.3.12) were counted towards ‘Design, develop, and deploy software’ (3.2.3).

Accuracy of analysis

We assessed the accuracy of our analysis by manually checking an additional randomly selected 50 job adverts and identifying any tags that had been missed or added incorrectly by the tagging algorithm.

Across the 50 jobs there were 468 tags in 383 categories. We found that 5 (1.3%) of these categories were incorrect – for example an advert for an administrative role described the employer as an ‘electronics’ company, and the job was incorrectly classified as requiring knowledge of electronics. We also found that there were 30 tags (6.4%) that we would have applied but had not been by the algorithm – for example we would have tagged ‘autonomous and challenge-driven’ as an example of the skill of working independently.

These errors were not corrected, as we aimed to strike a balance between the time needed to manually classify all the jobs and the error rate associated with doing so automatically, and we believe that this low error is an acceptable tradeoff. We hope to improve this error rate in future work.

Job classification

We classified the jobs manually by specific functional area based on their job title using the keywords below and the text of the job description where necessary. We then grouped functional areas into the categories and subcategories shown below.

Jobs were only classified into one functional area. Jobs which spanned more than one area were classified into the most relevant area, but we recognise that this will not always be a perfect fit.

| Category | Indicative Keywords |

|---|---|

| Engineering | |

| General engineering | Engineer (where not otherwise categorised below) |

| Electrical & Electronic engineering | Electrical, electronics, RF, microwave, PCB, antenna, spectrum, avionics, communications |

| Systems & AIT | Systems engineer, design engineer, quality, robotics, instrumentation |

| Mechanical, Thermal, and Propulsion | Mechanical, thermal, insulation, propulsion, CAD, materials, launch systems |

| Mission operations | Spacecraft control, satellite operations, control systems, ground systems, mission operations & planning |

| Technicians | Technician |

| Computing & Data Analysis | |

| Software engineering | Software, developer, UX, website, cyber |

| Data analysis | Data analyst, data scientist |

| Remote sensing | Remote sensing, GIS, GNSS, Earth observation |

| Science research | Scientist, researcher, astronomer |

| Business | Business analyst, business manager, business development, bid manager, PR & communications, marketing, sales |

| Administration | Administrator, assistant, receptionist, events, finance, HR, IT, project manager |

| Education & Outreach | Teacher, education & outreach officer, presenter, explainer, |

| Policy | Policy, law, regulation, contracts |

| Other | Journalism |

Employer classification

We classified business employers manually by size and by segment using the information provided on their websites and LinkedIn profiles. Non-business employers such as universities, non-profits, and outreach providers are not included in size breakdowns.

Size classifications

We used the OECD’s definitions for business size for our classification 5.

| Business Size | Number of employees |

|---|---|

| Micro | 1 - 9 |

| Small | 10 - 49 |

| Medium | 50 - 249 |

| Large | 250+ |

Segments classifications

We used segment definitions that are broadly the same as those used by the UK Space Agency 1.

Employers were only classified into one business area. Employers whose activities spanned more than one business area were classified into the most relevant area, but we recognise that this will not always be a perfect fit.

| Business Area | Segment |

|---|---|

| Satellite/payload manufacturing | Upstream |

| Subsystem supplier | Upstream |

| Component/materials supplier | Upstream |

| Prime/system integrator | Upstream |

| Testing | Upstream |

| Launch vehicles and subsystems | Upstream |

| Launch services | Upstream |

| Ground segment equipment | Upstream |

| Software, IT, and other engineering services | Varied depending on company specialism |

| Ground segment operator | Downstream |

| Satellite operations | Downstream |

| Satellite service provision (broadcast, comms, navigation, EO, weather etc.) | Downstream |

| Sat data processing | Downstream |

| User equipment | Downstream |

| Satellite data user | Downstream |

| Research & development | Ancillary |

| Policy & regulation | Ancillary |

| Finance, insurance, and other support services | Ancillary |

| Education & outreach | Ancillary |

Results

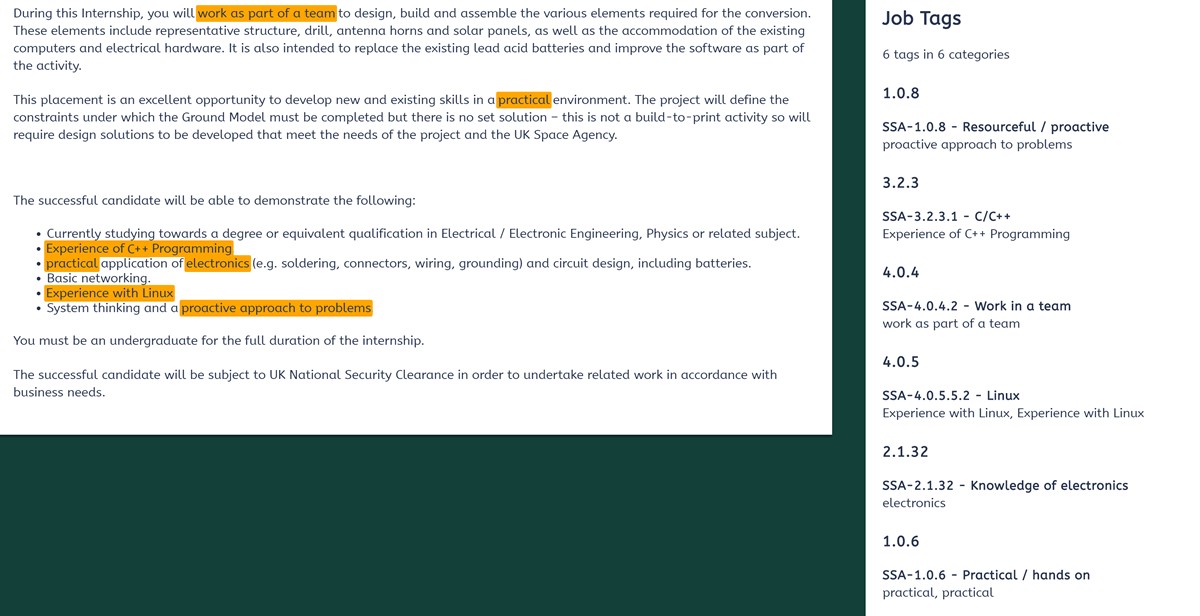

In this section we present the top competencies identified by our analysis of the SCUK dataset, with a cut-off of appearing in at least 10% of jobs. We identify the competency type, specific competency, and the percentage of jobs within the dataset which mention the competency or one of its subcompetencies. We present the top competencies by company size and segment, and by job classification.

The ‘all jobs’ figures presented below are not weighted to characteristics of the UK space sector, so in cases where there is significant variation in demand between different sector segments or sizes of employer, the ‘all jobs’ figure may not be an accurate representation of the sector as a whole and the segmented tables should be used instead (see the Limitations section).

Competency demand for all jobs

Competency demand by job area

| Competency | All jobs | Engineering | Computing & Data Analysis | Science research | Business | Administration | Policy | Education & Outreach | Other |

|---|---|---|---|---|---|---|---|---|---|

| n = 812 | n = 339 | n = 207 | n = 44 | n = 83 | n = 65 | n = 18 | n = 32 | n = 7 | |

| Interpersonal skills | 84 | 81 | 82 | 89 | 89 | 91 | 72 | 91 | 71 |

| Communication skills | 76 | 76 | 65 | 82 | 93 | 85 | 89 | 88 | 86 |

| Design, develop, and deploy software | 49 | 49 | 86 | 43 | 11 | 15 | 11 | 9 | 0 |

| Analytical skills | 46 | 54 | 46 | 55 | 36 | 28 | 72 | 6 | 14 |

| English | 38 | 33 | 35 | 45 | 55 | 45 | 67 | 13 | 43 |

| IT skills | 33 | 24 | 44 | 9 | 31 | 65 | 44 | 34 | 29 |

| Self-motivated | 23 | 23 | 22 | 25 | 30 | 26 | 6 | 13 | 0 |

| Resourceful / proactive | 22 | 22 | 19 | 18 | 34 | 22 | 28 | 19 | 29 |

| Work independently | 21 | 18 | 19 | 16 | 28 | 26 | 39 | 28 | 0 |

| Willing to travel | 20 | 15 | 23 | 16 | 19 | 34 | 17 | 22 | 14 |

| Enthusiastic | 18 | 15 | 16 | 23 | 19 | 20 | 0 | 53 | 14 |

| Flexible | 18 | 15 | 15 | 16 | 17 | 34 | 28 | 25 | 14 |

| Practical / hands on | 17 | 27 | 13 | 18 | 6 | 8 | 6 | 13 | 0 |

| Process and analyse data | 17 | 15 | 33 | 18 | 2 | 8 | 6 | 0 | 0 |

| Knowledge of electronics | 17 | 32 | 9 | 2 | 2 | 9 | 0 | 0 | 0 |

| Problem solve | 16 | 21 | 16 | 7 | 13 | 17 | 6 | 3 | 0 |

| Planning & organisation | 16 | 12 | 8 | 25 | 27 | 26 | 28 | 34 | 29 |

| Attention to detail | 15 | 16 | 11 | 7 | 13 | 29 | 6 | 13 | 14 |

Competency demand by job subarea (Engineering)

| Competency | All jobs | Mechanical, Thermal, and Propulsion | Electrical & Electronic engineering | Systems & AIT | Technician |

|---|---|---|---|---|---|

| n = 812 | n = 53 | n = 133 | n = 57 | n = 12 | |

| Interpersonal skills | 84 | 89 | 82 | 91 | 75 |

| Communication skills | 76 | 81 | 72 | 70 | 75 |

| Design, develop, and deploy software | 49 | 40 | 50 | 51 | 17 |

| Analytical skills | 46 | 74 | 51 | 54 | 8 |

| English | 38 | 36 | 32 | 16 | 25 |

| IT skills | 33 | 30 | 22 | 21 | 50 |

| Self-motivated | 23 | 28 | 17 | 26 | 8 |

| Resourceful / proactive | 22 | 25 | 22 | 25 | 17 |

| Work independently | 21 | 19 | 17 | 18 | 17 |

| Willing to travel | 20 | 17 | 15 | 21 | 0 |

| Enthusiastic | 18 | 15 | 14 | 12 | 8 |

| Flexible | 18 | 13 | 12 | 18 | 17 |

| Practical / hands on | 17 | 40 | 25 | 32 | 17 |

| Process and analyse data | 17 | 2 | 21 | 21 | 0 |

| Knowledge of electronics | 17 | 13 | 51 | 26 | 25 |

| Problem solve | 16 | 28 | 21 | 25 | 42 |

| Planning & organisation | 16 | 15 | 8 | 14 | 50 |

| Attention to detail | 15 | 17 | 19 | 16 | 50 |

Competency demand by job subarea (Computing & Data Analysis)

| Competency | All jobs | Software Engineering | Data Analysis | Remote sensing |

|---|---|---|---|---|

| n = 812 | n = 132 | n = 21 | n = 50 | |

| Interpersonal skills | 84 | 84 | 86 | 76 |

| Communication skills | 76 | 66 | 62 | 64 |

| Design, develop, and deploy software | 49 | 95 | 71 | 70 |

| Analytical skills | 46 | 36 | 67 | 66 |

| English | 38 | 41 | 19 | 26 |

| IT skills | 33 | 53 | 14 | 36 |

| Self-motivated | 23 | 27 | 10 | 14 |

| Resourceful / proactive | 22 | 23 | 10 | 14 |

| Work independently | 21 | 19 | 14 | 22 |

| Willing to travel | 20 | 24 | 24 | 16 |

| Enthusiastic | 18 | 17 | 0 | 12 |

| Flexible | 18 | 15 | 5 | 18 |

| Practical / hands on | 17 | 10 | 14 | 14 |

| Process and analyse data | 17 | 23 | 33 | 62 |

| Knowledge of electronics | 17 | 11 | 5 | 0 |

| Problem solve | 16 | 17 | 0 | 18 |

| Planning & organisation | 16 | 8 | 10 | 8 |

| Attention to detail | 15 | 11 | 10 | 12 |

Competency demand by employer segment

| Competency | All jobs | upstream | Downstream | ancillary | academia |

|---|---|---|---|---|---|

| n = 812 | n = 279 | n = 184 | n = 331 | n = 18 | |

| Interpersonal skills | 84 | 82 | 83 | 86 | 72 |

| Communication skills | 76 | 76 | 66 | 82 | 72 |

| Design, develop, and deploy software | 49 | 52 | 60 | 41 | 22 |

| Analytical skills | 46 | 48 | 49 | 43 | 33 |

| English | 38 | 37 | 34 | 41 | 17 |

| IT skills | 33 | 28 | 35 | 36 | 22 |

| Self-motivated | 23 | 24 | 17 | 25 | 22 |

| Resourceful / proactive | 22 | 28 | 14 | 20 | 33 |

| Work independently | 21 | 17 | 20 | 24 | 33 |

| Willing to travel | 20 | 16 | 22 | 20 | 39 |

| Enthusiastic | 18 | 15 | 13 | 23 | 17 |

| Flexible | 18 | 13 | 23 | 19 | 11 |

| Practical / hands on | 17 | 22 | 13 | 16 | 28 |

| Process and analyse data | 17 | 13 | 25 | 15 | 11 |

| Knowledge of electronics | 17 | 28 | 8 | 12 | 17 |

| Problem solve | 16 | 15 | 11 | 20 | 17 |

| Planning & organisation | 16 | 10 | 11 | 24 | 22 |

| Attention to detail | 15 | 16 | 10 | 16 | 11 |

Competency demand by business employer size

| Competency | All jobs | micro | small | medium | large |

|---|---|---|---|---|---|

| n = 812 | n = 35 | n = 94 | n = 207 | n = 281 | |

| Interpersonal skills | 84 | 86 | 82 | 90 | 79 |

| Communication skills | 76 | 54 | 71 | 67 | 83 |

| Design, develop, and deploy software | 49 | 54 | 49 | 48 | 61 |

| Analytical skills | 46 | 34 | 43 | 42 | 56 |

| English | 38 | 31 | 36 | 35 | 38 |

| IT skills | 33 | 23 | 44 | 37 | 32 |

| Self-motivated | 23 | 14 | 28 | 32 | 20 |

| Resourceful / proactive | 22 | 6 | 28 | 24 | 21 |

| Work independently | 21 | 9 | 24 | 21 | 16 |

| Willing to travel | 20 | 14 | 28 | 14 | 23 |

| Enthusiastic | 18 | 20 | 14 | 17 | 21 |

| Flexible | 18 | 17 | 27 | 17 | 15 |

| Practical / hands on | 17 | 20 | 31 | 17 | 16 |

| Process and analyse data | 17 | 17 | 18 | 15 | 21 |

| Knowledge of electronics | 17 | 23 | 20 | 28 | 13 |

| Problem solve | 16 | 17 | 19 | 14 | 17 |

| Planning & organisation | 16 | 14 | 20 | 14 | 12 |

| Attention to detail | 15 | 3 | 16 | 19 | 15 |

What does the data say?

Technical skills & knowledge

The most significant result in this analysis is the very high demand for software development and data analysis skills (49%), which are by far the most sought after technical skills. For comparison, the next highest technical competency is knowledge of electronics at just 17%.

Specifically, demand appears to be highest for expertise in C and C++ (22%), Python (20%), MATLAB (12%), and Java (11%). It should be noted that many adverts list multiple programming languages and state that experience with any is acceptable.

Unsurprisingly, this demand is highest in software engineering roles (95% vs 49% for all jobs), but these skills are in high demand across all segments and sizes of employers, and particularly in downstream companies (60%). This is significant because the downstream space sector – space applications and data companies – employs the vast majority (79%) of space sector workers and has grown at an average rate of 5% per annum in the last five years 1b, so the demand for these skills will only increase.

This aligns with the results of the EO4GEO Space/Geospatial Sector Skills Strategy which found “the results of the job advertisements analysis confirmed the importance of recognizing ‘Programming and development’ as a key EO/GI skill sets, alongside other skills sets such as ‘Analytical Methods’” 6.

Similarly, in remote sensing roles data analysis (62% vs 17% for all jobs) and GIS skills (71% vs 9%) are most in demand, CAD skills are wanted for mechanical, thermal, and propulsion engineering (52% vs 8%) and electronics skills are most in demand in electronic engineering roles (51% vs 19% for all jobs). These variations are also reflected in the analysis by company segment, with upstream companies demanding electronics and CAD skills, and downstream ones demanding data analysis and GIS skills.

Transferable skills

There is a very high demand for transferable skills ranging from ‘softer’ interpersonal and communication skills (84%), to ‘harder’ analytical and problem solving skills (46%). It is possible that true demand is higher still, as a requirement for certain transferable skills is often implied rather than specifically mentioned, though findings by the Skills Builder Partnership in analysis of job adverts across all sectors 7 suggest that this adverts for early career roles tend to be more explicit. A handful of job adverts make no mention of any transferable skills, focusing solely on technical ones.

Breaking down the demand for transferable skills by job area shows the unsurprising results that engineering roles require a practical or hands-on attitude (27% vs 17% for all jobs), and outreach roles require enthusiasm (53% vs 18%). Resourcefulness and proactivity are demanded more for business (34% vs 22%) and policy (28%) roles.

There is also a large degree of variation between job areas for analytical skills, ranking highest in mechanical, thermal, and propulsion engineering (74%), policy (72%), data analysis (67%), and remote sensing (66%), and lowest in outreach (6%), and technician roles (8%).

Adverts for technician roles ask for certain transferable skills such as attention to detail (50% vs 15% for all jobs) and organisation (50% vs 16%) much more often. This may accurately reflect higher demand for these skills in technician roles, but it may also be a result of distortions from a very small sample size of just 12.

The majority of transferable skills see very similar demand in both segments. A practical or hands-on attitude is in higher demand for upstream companies (22% vs 13% for downstream jobs) which is explained by the differences in typical job roles. Interestingly, upstream demand is also notably higher for people who are resourceful (28% vs 14%) and self-motivated (24% vs 17%), whilst downstream demand is higher for people who are flexible (23% vs 13% for upstream jobs). It’s not clear why these transferable skills show this variation, as at first glance they appear to be independent of the business area.

Traits

A large number of the most demanded competencies are traits. This is significant because these characteristics are more difficult to formally teach, and are typically cultivated over a long period from a very early age (such as creativity and self-motivation), or form part of a person’s personality or personal preferences (such as enthusiasm and willingness to travel). They are likely to be beyond the scope of the space sector’s immediate skills pipeline, but the sector should support efforts to develop character throughout formal and informal education.

What does this mean for the space sector?

An important point to note before examining the implications of these results on the space sector is that this data only tells us the demand for competencies and not where there are shortages. More work is needed before we can get a clearer picture of the sector’s skills shortages.

The space skills shortage is largely a tech skills shortage

The size of demand for programming skills over all other technical skills strongly suggests that the space skills shortage is largely a subset of the UK’s larger tech skills shortage, which has already been extensively documented. The House of Commons Science and Technology Committee said in 2016 that ‘the UK faces a digital skills crisis’ and found that the digital skills gap is affecting 93% of UK tech companies 8, and in 2018 the Edge Foundation reported that there were more than 600,000 tech vacancies 9.

Looking at the space sector specifically, the 2014 Space IGS Skills Theme Report highlighted a ‘lack of technical computing and programming skills in the workforce as a whole and recent graduates in particular’, drawing on data from NERC, AIRTO, and others 3a. The IGS report noted that:

In general […] employers did not have difficulty filling positions since the pool of applicants is global. Where indigenous graduates might lack the modelling and mathematical analysis skills these skills can be sourced from overseas.

Space Innovation and Growth Strategy 2014 ‐ 2030: Skills Theme Report 2

This is especially noteworthy in the context of Brexit, which is expected to significantly increase barriers to hiring from overseas and significantly impact the aerospace industry’s skills pipeline 10.

The very high demand for programming skills which we present has significant implications for the design of the space sector’s recruitment pipeline from school outreach through to ongoing professional development training. Programming skills must be a priority in the sector’s skills strategy.

Demand for these particular skills also puts the space sector in direct competition with the broader tech sector, which offers a higher profile (of the 20 most recognised brands in the world, 50% are tech companies 11) and higher average pay 12.

If it is to properly compete, then work must be done to address this imbalance and raise the profile of the space sector among tech professionals and graduates.

The root causes of the skills shortage must also be addressed. The tech sector has already invested a great deal of resources into tackling this problem. The space sector must draw on the lessons learned from this work in the development of its own strategy both independent of and in partnership with the tech sector.

Transferable skills are vitally important

It is perhaps unsurprising that our analysis shows a very high demand for transferable skills; it is to be expected from their very definition. However this is useful further evidence of the importance of these skills and the impact that not having them can have on a technically skilled candidate’s prospects.

The 2014 Space IGS Skills Theme Report highlighted a ‘lack of understanding of the importance of professional communication’ 3a, and research from the wider engineering and STEM sectors have reported that many employers feel graduates do not have these skills to the level that they expect. The 2016 Wakeham Review found that only 25% of employers felt that STEM graduates had the ‘work ready’ skills they needed 13, whilst the IET’s 2019 Skills Survey found that 73% of companies had a problem with candidates who have academic knowledge but lack workplace skills 14. This is considerably more than the 59% of companies that were concerned about a shortage of engineering or technical skills at a professional level.

These findings reinforce the importance of transferable skills, and the sector must ensure that they are taught and developed alongside technical ones.

Future work

There are a number of avenues for further research building on this analysis.

We intend to run similar analysis on other datasets that cover jobs outside of early careers to get an indication of if and how demand varies between different career levels.

We want to look more closely at demand for programming skills, particularly which languages are in most demand and why, and what work has already been done to attract people with these skills into the space sector and to upskill those already in the sector.

We also want to better understand how the demand we have identified compares to skills shortages within the sector. How many of the vacancies we have examined are being filled, and do those people who are recruited have all the skills that are being asked for?

Limitations

Analysis limitations

Demand vs shortages

Our analysis gives an indication of the demand for certain competencies within the UK space sector, but without knowing the supply of workers with these competencies, we are not able to make conclusions about where the shortages are. This is an area for future research.

Adverts are a proxy

We assume that the competencies asked for in job adverts are the ones employers want, but this may not always be the case. Job adverts may be poorly written, or may treat certain skills (such as time management) as implicit and not necessary to specify.

Dataset limitations

Early careers bias

The SCUK dataset is made up of adverts for early career space jobs. The competencies demanded for early career jobs may be different from the demand across the sector more generally. In future work we will look at wider datasets to examine this in more detail.

Inclusion of non-UK jobs

Though we present our analysis as being an assessment of skills demand in the UK space sector, about 30% of the jobs in the SCUK dataset are based outside of the UK. Of these, most (28%) are based in Europe, primarily Germany (10%) and the Netherlands (4%).

SpaceCareers.uk advertised these roles as they were open to British nationals, and we include them as many relate to work in which the UK is closely involved, or to agencies such as ESA of which the UK is a member country.

There is no indication that the demands of the European space sector are significantly different from those of the UK’s, and many of these roles may need to be duplicated in the UK after Brexit if the UK develops replacement for EU programmes such as Galileo 15.

UK regional bias

The SCUK dataset has a significant bias toward companies in the South East of England and Scotland at the expense of London, the South West, and the East of England compared to data from the UK Space Agency’s Size and Health report 1d.

| Region | SCUK Dataset (% of jobs) | S&H 2018 (% of employees) |

|---|---|---|

| Scotland | 8.7 | 18.1 |

| North East | 0.2 | 2.2 |

| North West | 1.6 | 5.6 |

| Yorkshire and the Humber | 0.3 | 3.1 |

| East Midlands | 5.2 | 2.1 |

| West Midlands | 0.2 | 2.8 |

| East of England | 5.7 | 10.5 |

| Wales | 0.5 | 1.2 |

| London | 9.0 | 29.4 |

| South East | 53.9 | 21.6 |

| South West | 9.4 | 3.2 |

| Northern Ireland | 0 | 0.3 |

| Other (includes jobs with no fixed location) | 5.2 | 0 |

It is not clear why this is the case, but as a result care should be taken when considering our findings in a regional context. We have chosen not to segment our results by region because the sample size for some regions is too small to be a useful indication of demand in those regions.

Upstream bias

The SCUK dataset is significantly biased toward upstream companies compared to data from the UK Space Agency’s Size and Health report 1b.

| Segment | SCUK Dataset % of jobs | S&H 2018 % of jobs |

|---|---|---|

| Downstream | 35 | 81 |

| Upstream | 65 | 19 |

It is not clear why this is the case. One possibility is that upstream companies tend to be larger with well developed internship programmes and graduate intakes, while downstream companies tend to be smaller and less able to take on a large number of early career employees. Additionally, the Space Placements in Industry (SPIN) programme which places a large number of undergraduate and postgraduate students in primarily downstream summer internships is only represented in the SCUK data only as a single post per year and not as multiple individual posts.

As a result, where there is a significant variation between upstream and downstream demand for a competency (such as for data analysis skills), the ‘all jobs’ figure should not be considered an accurate picture of sector-wide demand, and instead demand should be looked at on a sector-specific basis.

Individual job bias

SpaceCareers.uk cautioned that some schemes with large numbers of openings – for example the ESA Young Graduate Trainee Programme – are represented by only a single advert per year.

Acknowledgements

We are grateful to UKSEDS for sharing their data from SpaceCareers.uk, without which this work would not have been possible. We would also like to extend a special thank you to Portia Bowman and Rob Garner for their advice and ideas, to James Telfer and Jacob Smith for proofing this paper, to our advisors Ed Chester, Julia Hunter-Anderson, and Sheila Kanani, and to Nigel Bannister and Roy Haworth for their suggestions and support in developing the competency taxonomy.

Licence

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. You can copy, redistribute, and adapt what we’ve presented for any non-commercial purpose. However, you must give us credit and link back to this page. If you want to use it in a commercial context, get in touch with us at info@spaceskills.org.

References

- ^ (). The Size and Health of the UK Space Industry 2018, a: pp. 16–17, b: pp. 17–18, c: p. 19, d: p. 22. London Economics.

- ^ (). A UK Space Innovation and Growth Strategy 2010 to 2030, p. 10.

- ^ (). Space Innovation and Growth Strategy 2014 – 2030: Skills Theme Report, a: p. 4.

- ^ (). Towards a space competencies taxonomy. Space Skills Alliance.

- ^ (). Small and Medium-Sized Enterprises (SMEs).

- ^ (). Space/Geospatial Sector Skills Strategy, p. 57. EO4GEO Consortium.

- ^ (). Towards a Universal Framework for Essential Skills, p. 53. Skills Builder Partnership.

- ^ (). Digital skills crisis: Second Report of Session 2016–17, p. 3.

- ^ (). Skills Shortages in the UK Economy: Edge Bulletin 2, p. 12.

- ^ (). The impact of Brexit on the aerospace sector: Sixth Report of Session 2017–19, p. 17.

- ^ (). Best Global Brands 2018 Rankings.

- ^ (). EARN03: Average weekly earnings by industry.

- ^ (). Wakeham Review of STEM Degree Provision and Graduate Employability, p. 41. Department for Business, Innovation & Skills.

- ^ (). IET Skills and Demand in Industry: 2019 Survey.

- ^ (). Satellites and space programmes from 1 January 2021.

Appendix

This appendix gives a breakdown of the characteristics of the SCUK dataset use in our analysis.

Breakdown by country

| Country | Number of jobs (count) | Number of jobs (%) |

|---|---|---|

| Austria | 9 | 1.1 |

| Belgium | 9 | 1.1 |

| Bulgaria | 1 | 0.1 |

| Canada | 2 | 0.2 |

| Chile | 1 | 0.1 |

| Czech Republic | 2 | 0.2 |

| Denmark | 3 | 0.4 |

| Europe Wide | 2 | 0.2 |

| Finland | 7 | 0.9 |

| France | 20 | 2.5 |

| French Guiana | 2 | 0.2 |

| Germany | 79 | 9.7 |

| Ireland | 1 | 0.1 |

| Italy | 15 | 1.8 |

| Japan | 9 | 1.1 |

| Luxembourg | 7 | 0.9 |

| Norway | 1 | 0.1 |

| Poland | 2 | 0.2 |

| Portugal | 1 | 0.1 |

| Spain | 13 | 1.6 |

| Sweden | 4 | 0.5 |

| Switzerland | 2 | 0.2 |

| The Netherlands | 36 | 4.4 |

| UK | 573 | 70.6 |

| USA | 9 | 1.1 |

| Worldwide | 2 | 0.2 |

Breakdown by UK region

| Region | Number of jobs (count) | Number of jobs (%) |

|---|---|---|

| East Midlands | 30 | 3.7 |

| East of England | 33 | 4.1 |

| London | 52 | 6.4 |

| North East | 1 | 0.1 |

| North West | 9 | 1.1 |

| Scotland | 50 | 6.2 |

| South East | 310 | 38.2 |

| South West | 54 | 6.7 |

| Wales | 3 | 0.4 |

| West Midlands | 1 | 0.1 |

| Yorkshire and the Humber | 2 | 0.2 |

| Other | 30 | 3.7 |

| Non UK | 237 | 29.2 |

Breakdown by job types

| Job Type | Number of jobs (count) | Number of jobs (%) |

|---|---|---|

| Apprenticeship | 17 | 2.1 |

| Direct Entry Job | 410 | 50.5 |

| Graduate Position | 190 | 23.4 |

| Internship | 195 | 24.0 |

Breakdown by job category and functional area

| Category | Functional Area | Number of jobs (count) | Number of jobs (%) |

|---|---|---|---|

| - | Mixed | 16 | 2.0 |

| Administration | Administration | 14 | 1.7 |

| Administration | IT | 6 | 0.7 |

| Administration | Events | 7 | 0.9 |

| Administration | Finance | 10 | 1.2 |

| Administration | HR | 2 | 0.2 |

| Administration | Management | 2 | 0.2 |

| Administration | Project management | 21 | 2.6 |

| Administration | Recruitment | 3 | 0.4 |

| Business | Business Analyst | 7 | 0.9 |

| Business | Business Development | 18 | 2.2 |

| Business | Communication | 27 | 3.3 |

| Business | Marketing | 17 | 2.1 |

| Business | Sales | 14 | 1.7 |

| Computing & Data Analysis | Architecture | 6 | 0.7 |

| Computing & Data Analysis | Artificial Intelligence and Machine Learning | 3 | 0.4 |

| Computing & Data Analysis | Data Analysis | 16 | 2.0 |

| Computing & Data Analysis | Data science | 5 | 0.6 |

| Computing & Data Analysis | Geospatial | 1 | 0.1 |

| Computing & Data Analysis | Software Engineering | 124 | 15.3 |

| Computing & Data Analysis | Remote sensing | 49 | 6.0 |

| Computing & Data Analysis | Web Development | 3 | 0.4 |

| Education & Outreach | Outreach | 32 | 3.9 |

| Engineering | Assembly, Integration and Test | 12 | 1.5 |

| Engineering | Astrodynamics | 16 | 2.0 |

| Engineering | Technician | 12 | 1.5 |

| Engineering | Telecommunication | 14 | 1.7 |

| Engineering | Control | 12 | 1.5 |

| Engineering | Design | 1 | 0.1 |

| Engineering | Electrical | 11 | 1.4 |

| Engineering | Electronics | 75 | 9.2 |

| Engineering | Systems & AIT | 34 | 4.2 |

| Engineering | Materials | 2 | 0.2 |

| Engineering | Mechanical | 34 | 4.2 |

| Engineering | General engineering | 33 | 4.1 |

| Engineering | Mission Planning | 5 | 0.6 |

| Engineering | Propulsion | 7 | 0.9 |

| Engineering | Quality | 6 | 0.7 |

| Engineering | Systems | 33 | 4.1 |

| Engineering | Space systems | 5 | 0.6 |

| Engineering | Spacecraft Operator | 18 | 2.2 |

| Engineering | Structural | 3 | 0.4 |

| Engineering | Thermal | 7 | 0.9 |

| Other | Education | 3 | 0.4 |

| Other | Journalism | 4 | 0.5 |

| Policy | Policy | 18 | 2.2 |

| Science research | Science research | 41 | 5.0 |

| Science research | Earth Science | 2 | 0.2 |

| Science research | Physiology | 1 | 0.1 |

Breakdown by employer segment and business area

| Segment | Business Area | Number of jobs (count) | Number of jobs (%) |

|---|---|---|---|

| Ancillary | Non-profit | 26 | 3.2 |

| Ancillary | Policy and regulation | 5 | 0.6 |

| Ancillary | Space agency | 48 | 5.9 |

| Ancillary | Other | 55 | 6.8 |

| Ancillary | Research & development | 50 | 6.2 |

| Ancillary | Consultancy | 8 | 1.0 |

| Ancillary | Academia | 92 | 11.3 |

| Ancillary | Marketing and communications | 3 | 0.4 |

| Ancillary | Education & Outreach | 22 | 2.7 |

| Ancillary | Market research and consulting | 3 | 0.4 |

| Ancillary | Recruitment | 21 | 2.6 |

| Downstream | Downstream software and IT | 1 | 0.1 |

| Downstream | Satellite data user | 1 | 0.1 |

| Downstream | Ground segment equipment | 5 | 0.6 |

| Downstream | Satellite meteorological service provision | 3 | 0.4 |

| Downstream | Satellite operations | 2 | 0.2 |

| Downstream | Sat data processing | 47 | 5.8 |

| Downstream | Satellite communication service provision | 24 | 3.0 |

| Downstream | Satellite EO service provision | 30 | 3.7 |

| Downstream | Ground segment operator | 22 | 2.7 |

| Downstream | Midstream software and IT | 29 | 3.6 |

| Downstream | Midstream support services | 27 | 3.3 |

| Downstream | Satellite navigation service provision | 9 | 1.1 |

| Upstream | Upstream software and IT | 1 | 0.1 |

| Upstream | Prime/system integrator | 62 | 7.6 |

| Upstream | Launch services | 7 | 0.9 |

| Upstream | Launch vehicles and subsystems | 22 | 2.7 |

| Upstream | Component/materials supplier | 36 | 4.4 |

| Upstream | Testing services | 2 | 0.2 |

| Upstream | Upstream support services | 4 | 0.5 |

| Upstream | Subsystem supplier | 46 | 5.7 |

| Upstream | Robotics | 4 | 0.5 |

| Upstream | Satellite/payload manufacturing | 95 | 11.7 |

Breakdown by employer size

| Size Classification | Number of jobs (count) | Number of jobs (%) |

|---|---|---|

| Micro | 35 | 4 |

| Small | 94 | 12 |

| Medium | 207 | 25 |

| Large | 281 | 35 |

| n/a | 195 | 24 |